Where Is All The Marijuana Money Going

[Courtesy Councilman Kashmann’s Newsletter]

While the legalization of weed has, indeed, given our state and city coffers a nice injection of new dollars, it has not proven the game changer some envision it to be. Let’s look at what revenue is coming in, and from what sources, and where it’s going.

There are two streams of legally sold marijuana – medical and recreational. And they are taxed quite differently.

Medical marijuana is subject to the same 2.9% state sales tax that is applied to clothing, auto parts, appliances, etc. It is also subject to Denver’s (as of 1/1/19) 4.31% sales tax, a 1% tax that goes to RTD and a .1% levy for the Scientific and Cultural Facilities District. All of which brings the tax on medical marijuana to 8.31%.

Recreational marijuana is subject to a much larger tax bump. While exempt from the standard 2.9% state sales tax, recreational weed purchases pay the standard Denver tax of 8.31%, as well as an additional 5.5% special Denver marijuana sales tax, and a 15% state marijuana sales tax. Thus, recreational users pay a hefty total of 24.31% on their purchases.

And, where is it going?

Denver’s 4.31% regular sales tax paid on all marijuana purchases goes into the city’s general fund to help pay for the full roster of city services and purchases.

The state 2.9% regular sales tax paid on medical marijuana purchases only, goes into the state’s Marijuana Tax Cash Fund (MCTF). The state 15% recreational marijuana sales tax is divided 90% to state coffers, and 10% to local governments around Colorado. The state’s 90% share falls into three buckets: 12.59% to the State Public School Fund distributed to the state’s many school districts; 15.56% goes to the state General Fund; and 71.85% to the MCTF. The city’s 10% share of the state marijuana sales tax goes into our General Fund.

Revenue from the state MTCF must be spent the following year on health care, monitoring marijuana health effects, health education, substance abuse prevention and treatment programs and law enforcement. MTCF funded programs for the Colorado Department of Education include: The School Health Professional Grant program to address behavioral health issues in schools; a grant program to reduce the frequency of bullying; grants to fund drop-out prevention programs; and Early Literacy Grants to ensure reading is embedded into K-3 education.

Denver’s 5.5% sales tax on recreational marijuana is broken up 3.5% to the General Fund and 2% to the Affordable Housing Fund. The ordinance that legalized recreational marijuana requires that we spend a portion of general fund marijuana revenue on enforcement, education and regulation and with the balance going to city services.

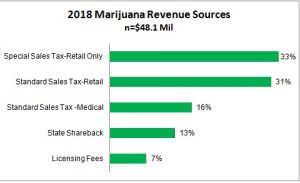

Denver’s 2018 revenue from marijuana sales included: $15.8-million from Denver’s standard sales tax on recreational marijuana; $7.7-million from Denver’s standard tax on medical marijuana; $15.1-million from the special sales tax on recreational marijuana; $6.1-million from the state for Denver’s share of the state special sales tax on recreational marijuana; and $3.4-million from marijuana licenses and fees, for a total revenue of $48.1-million.

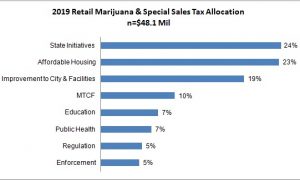

Our 2019 budget recommends: $2,576,163 for regulation (Excise and License, Community Planning and Development and Department of Public Health and Environment); $2,647,228 for enforcement (Police, Parks and Recreation, City Attorney); and $3,590,635 for education (Excise and License, Parks and Recreation, Department of Children’s Affairs, Denver Health, Office of Behavioral Health) for a total of $8,814,026. Another $3,115,961 is positioned for opioid intervention through DDPHE, and in addition to the $9.3-million for affordable housing from the sales tax, an additional $1.9-million will go in that direction from a General Fund allocation. The total amount of investment from marijuana dollars sits at $32,079,987.

In addition to the money detailed above from the state sales tax and the Denver revenue pile that goes to education, the state charges a 15% excise tax that is charged when wholesale marijuana is transferred from a grower to a dispensary or marijuana products manufacturer or testing facility. The first $40-million of that money, or 90%, whichever is greater, goes to school construction or renovation as part of the Building Excellent Schools Today competitive grant program. The remainder of the excise tax dollars go into a Public School Education Fund, the interest from which is spent on a variety of education efforts.

For a comprehensive look at Denver and marijuana, see the city’s annual report: https://www.denvergov.org/content/dam/denvergov/Portals/782/documents/Annual_Report_2018.pdf

![]()

Comments

Where Is All The Marijuana Money Going — No Comments

HTML tags allowed in your comment: <a href="" title=""> <abbr title=""> <acronym title=""> <b> <blockquote cite=""> <cite> <code> <del datetime=""> <em> <i> <q cite=""> <s> <strike> <strong>